Key benefits of outsourcing payroll services for small business

- Key benefits of outsourcing payroll services

Let’s begin with the strategic value that payroll outsourcing could offer in many small businesses, especially if you are still conserving your financial resources to grow.

The case of many SME in BPO is that they reserve as much capital as possible to fulfill core functions, and operate either online or from smaller storefronts.

There is not enough space, time, or capital to operate a full-fledged finance and accounting department to cater to payroll service. Not to mention you’ll need personnel that are equipped to juggle wages calculation, tax filing, or dealing with concerned government offices.

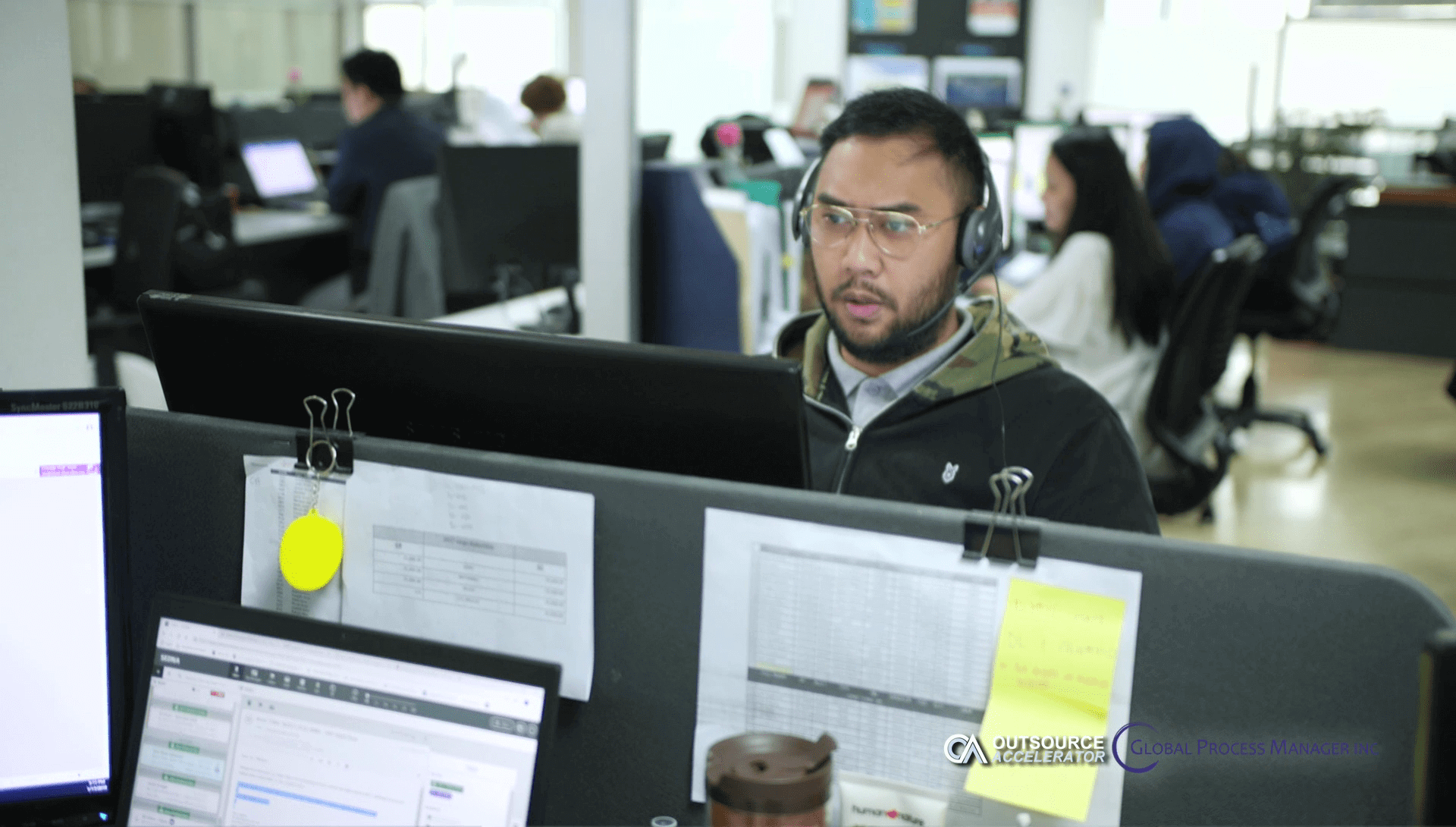

In a globalized and well-connected age of doing business, many SME in BPO industry have turned to outsourcing a number of finance- and accounting-related tasks, among them their payroll services.

You can find reliable payroll and accounting staff through a trustworthy firm like Set Up My Offshore.

Benefits of small business outsourcing services

To know more about the benefits of small business outsourcing services, take a look at our list below:

Reduced overhead costs

One good starting point is to assess how much overhead cost an in-house payroll management scheme would dictate to the company—this comes in the form of manpower, service hours, equipment, and the like.

In line with this, there are some convincing arguments toward choosing an outsourced solution: the availability of 24/7 service. It also offers streamlined channeling for email or chat, access to the best current technology, and the chance to scale up.

All of these are possible without putting out too much money for your investments and resources.

Allocation non-core tasks

There is no shame to outsource for tasks that fall outside of the business’s core competency. In fact, for a business that has yet to grow, this approach makes perfect sense.

There is no point in making an upfront demand that a small team be a “jack of all trades” when they are neither fully equipped nor properly compensated to be so.

Payroll services are now popularly outsourced alongside functions such as digital advertising and content management, web development, and others. Commissioning another firm to take on payroll services can free up valuable time and energy on behalf of your local staff, which in turn may be better invested in generating sales or recruitment.

Reduced margins of error

As critical a function of payroll management is to a business, the process itself is already very complex and susceptible to error.

When you tap small business outsourcing services, any errors—with regard to employees’ salary, can all be very costly to the business’s cash flow and reputation.

To mitigate any costly risks that pertain to payroll practices, it is a viable option to turn to small business outsourcing services. Professionals from the BPO sector are trained to handle any and all of these concerns with or without your company’s supervision.

A reputable partner will help you avoid these risks of processing the payroll late or incorrectly—and will save both the company’s assets and good standing to its employees, its government, and its clientele.

Specialized payroll skill sets

This is a new time and a new climate for businesses. Many SME in BPO, particularly those with digital storefronts and a growing base of overseas contractors, have to deal with new challenges in payroll management.

Among these are managing multi-currency arrangements. You have multiple levels to address for tax audit, specific protocols for zero-hour contracts, freelancers, part-time workers, and compliance requirements to conduct business.

Thus, it is a fair idea to call upon a payroll services company that possesses the knowledge, expertise, and savvy to deal with both local and offshore business offices.

Globalized and easily accessible technology

Payroll management is an evolving field of expertise for many SMEs. In the United States alone, companies have to adjust to thousands of federal, state, and local taxing jurisdictions. All of which are subject to change as time passes and the economy shifts.

Small businesses are not well-equipped to handle these constant changes alone. So they greatly benefit from partnership with outsourced payroll professionals that know how to navigate all of these systems.

Payroll services providers accommodate the changes using their own core processes. This includes services for payments, deposits, pay slips, pay stub management, and real-time compensation.

They also have proper investment and mastery of the latest payroll technologies, such as mobile computing, cloud computing, and application programming interfaces (API).

There will be no additional costs to pay for a BPO’s own drive for proficiency in the industry; these companies are constantly on the lookout for ways to increase their competitive advantages.

Outsourcing payroll services for small businesses

If you are a small business owner or someone who recently established a startup company, payroll should always be included in your priority lists.

Securing your own company’s payroll services will also ensure that all of your company’s employees are well-compensated, all of your expenses are liquidated, all of your income and profit are well-documented.

Small business outsourcing services include payroll and it is one of the most common functions you can outsource. All you have to do is find the right provider that can cater to your needs as a business owner.

Independent

Independent