Accrued payroll 101

It’s obvious that financial management is a fundamental aspect of running a business.

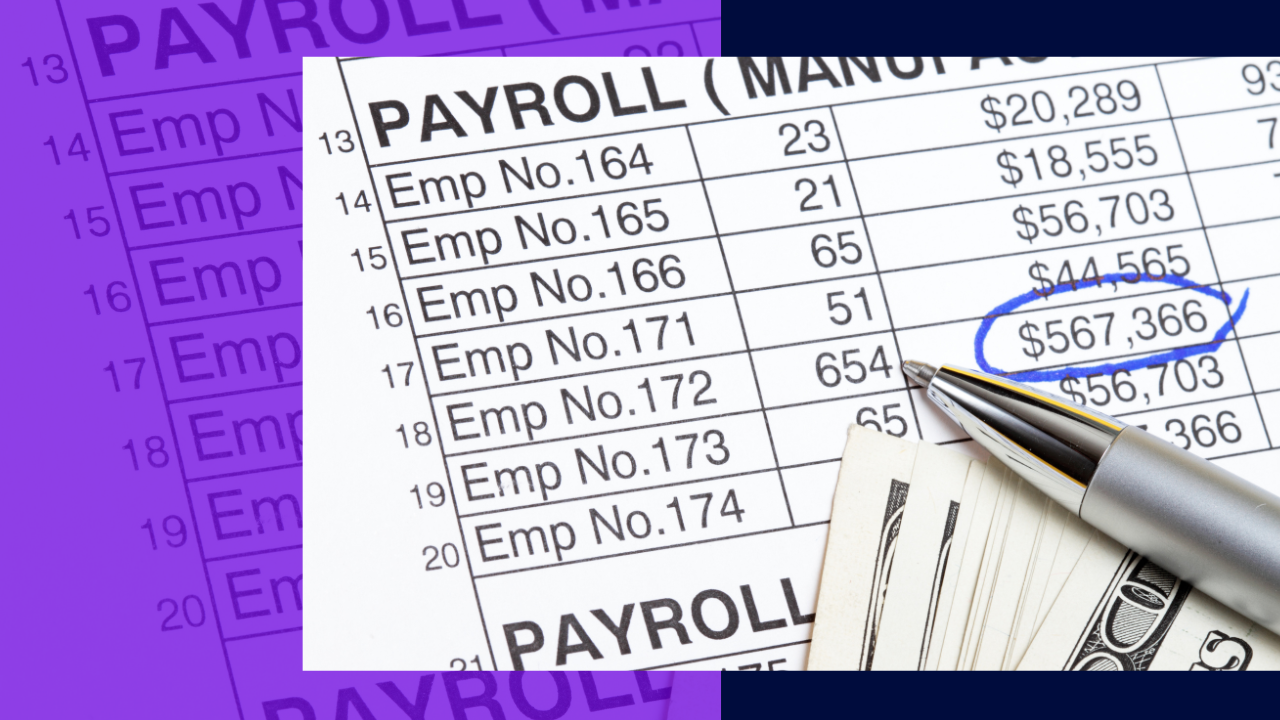

With that in mind, keeping an eye on payroll expenses is one of the most vital financial aspects. This is considering that labor costs can make up to 70% of overall operating expenses.

Given its substantial impact on cash flow, it’s essential to monitor payroll expenses throughout a pay period.

Let’s further delve into what accrued payroll is, how it’s calculated, and why it’s something every business should pay attention to.

What is accrued payroll?

Accrued payroll refers to the accumulation of wages and benefits earned by employees which are yet to be paid. It is recorded as a liability on the company’s balance sheet until the wages are disbursed.

This method ensures a company’s financial records accurately reflect its obligations to its employees. Accrued payroll is a cornerstone in ensuring your workforce is compensated accurately.

Alternative to payroll accrual

Alternatively, some businesses opt for cash accounting. It records expenses when they are paid rather than when they are incurred.

While cash accounting may seem simpler, it can lead to inaccuracies and discrepancies in employee compensation.

Accrual accounting provides a more accurate representation of a company’s financial obligations.

Importance of accrued payroll

Payroll accrual accounting is crucial for multiple reasons:

- Firstly, it ensures fair compensation to employees, as it accurately reflects the work done, including unpaid leaves and overtime.

- Secondly, it enables companies to maintain transparency and accountability in financial reporting.

- Payroll accrual accounting also assists in budgeting and forecasting. It lets businesses plan and allocate resources effectively.

Types of accrued payroll

Understanding the various components of accrued payroll is essential for meticulous financial management. Let’s explore the key types:

Salaries and wages

The backbone of any workforce, salaries and wages represent the core of accrued payroll. Ensuring timely and accurate recording is paramount for financial transparency.

Paid time off (PTO)

Employee well-being is crucial. PTO accrual ensures that employees receive their entitled time off without financial repercussions.

Payroll taxes

Navigating the complex world of payroll taxes is a challenge. Accruing them properly ensures compliance and avoids financial pitfalls.

Bonuses

Companies often offer bonuses to reward exceptional performance or to encourage employee motivation. These bonuses can be based on individual or team achievements.

Commissions

Accrued commissions are a common form of compensation for salespersons. They are particularly found in industries like real estate or financial services.

Social security contributions

This refers to the employer’s share of Social Security and Medicare taxes. These contributions are typically matched with the amount withheld from employees’ paychecks.

Employee benefits

Accruing benefits like annual leave or parental leave showcases a company’s commitment to a healthy work-life balance. These benefits are collected based on the time served or specific accrual policies.

How to calculate accrued payroll

Calculating payroll accruals involves tallying up all pending components mentioned above for each employee.

Then, naturally, you add those amounts to ascertain the overall sum for your entire staff. Here are the specific steps to follow for each employee:

1. Calculate the outstanding payroll

Calculating your employee’s wages is the first step in determining the accrued payroll.

Hourly wage x Hours worked = Outstanding gross pay per employee

Start by multiplying their gross hourly wage by the number of hours worked during the pay period you’re calculating for.

2. Factor in any additional pay elements

Now, let’s consider any additional pay elements like commissions, bonuses, and overtime. These should be added to the employee’s gross wages as specified in their employment contract.

For overtime, don’t forget to factor in the wage supplement and calculate it separately before adding it to the total owed to the employee.

3. Account for payroll taxes

Employer-paid payroll taxes and social security contributions need to be accounted for as well. Remember that these contributions are shared between the employee and employer.

While the employee’s share is already considered in their gross pay, you’ll need to calculate the employer’s contributions separately. This includes premiums for various insurances like:

- Health

- Long-term care

- Unemployment

- Accident

- Pension

Make sure to include the employer’s payroll taxes in the calculation too.

4. Consider PTO

Every month your employees work, they accrue a certain amount of paid time off (PTO). This applies even if they don’t take any time off during a specific pay period.

These accrued leave days represent a payroll liability that still needs to be paid, so be sure to take them into account.

Accrued payroll example

Let’s consider a hypothetical scenario to illustrate the calculation of accrued payroll.

Suppose a company has five employees. Their total monthly salaries amount to $20,000, paid time off is valued at $2,000, payroll taxes account for $3,000, bonuses and commissions sum up to $4,000, and employee benefits amount to $1,000.

Accrued payroll = $20,000 + $2,000 + $3,000 + $4,000 + $1,000 = $30,000

Thus, the company would record $30,000 as a liability until the paychecks are disbursed.

Streamlining the accrued payroll process

To streamline the accrued payroll process, take advantage of modern payroll management systems and software. These tools automate calculations and ensure accurate data entry, reducing the likelihood of human error.

Additionally, integrating these systems with time-tracking and attendance tools can simplify the process further.

By implementing efficient accrual tracking systems, you can stay organized, mitigate compliance risks, and improve overall payroll management.

To sum up, accrued payroll plays a vital role in fair employee compensation, financial reporting, and budgeting.

Understanding the different components, calculating accurately, and streamlining the process will not only benefit employees but also contribute to the overall success of the company.

Independent

Independent