Massive U.S. shortage

The United States is facing a critical shortage of accountants, leading to longer working hours and costly mistakes in earnings reports.

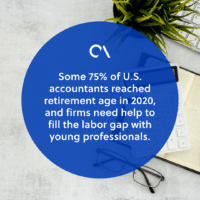

Numbers show that the U.S. is short of 340,000 accountants, and there are no signs of improvement. Some 75% of U.S. accountants reached retirement age in 2020, and firms need help to fill the labor gap with young professionals.

Data reveals that the number of people taking the CPA exam fell from a high of over 100,000 in 2016 to a 17-year low of 67,000 in 2022. While there was an uptick in 2023, the American Institute of Certified Public Accountants (AICPA) expects the decline to resume in the coming years.

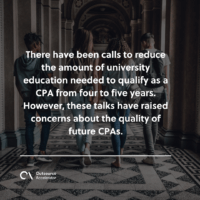

Hanging in the balance

There have been calls to reduce the amount of university education needed to qualify as a CPA from four to five years. However, these talks have raised concerns about the quality of future CPAs.

The AICPA has also encouraged firms to raise the salaries of new recruits but corporations are hesitant as this measure will only drive their expenses higher.

Is there a solution in sight? The longer the wait, the more critical errors these overworked accountants will make. Fortunately, the National Association of State Boards of Accountancy has found a solution offshore that could save the accounting segment in the U.S. from incurring more mistakes.

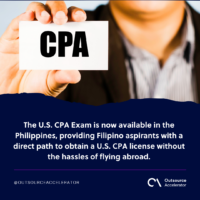

U.S. CPA exams now available in the Philippines

The U.S. CPA Exam is now available in the Philippines, providing Filipino aspirants with a direct path to obtain a U.S. CPA license without the hassles of flying abroad.

This is a great opportunity that U.S. accounting firms can capitalize on. It will allow them to fix workforce shortages that have been adversely affecting their operations.

An offshore workforce is available at a 70% discount without compromising on quality. Numbers show that the CPA licensure passing rate in the Philippines jumped to over 30% in 2023 from 20% in 2022. Filipino accounting prospects are getting better every day.

A combination of offshore and onshore accountants will empower these struggling U.S. accounting firms to turn things around. These offshore professionals have a deep understanding of U.S. accounting standards, regulations, and best practices, so these firms can seamlessly expand services and stretch their global footprint.

This new development has put the accounting industry in a sweet spot. Tapping offshore accountants will stabilize and strengthen the U.S. financial systems, a game-changing initiative that could boost global economic performance.

The question for your business

Have you explored offshore accountants for your business?

Independent

Independent