The rising importance of data engineering services in finance

This article is a submission by Innowise. Innowise is a software development and IT consulting company founded in 2007 that helps organizations achieve goals with digital solutions and recent technologies.

In the financial sector, data has become the lifeblood that drives decision-making, enhances operational efficiency, and fosters innovation.

As financial institutions amass vast amounts of data daily, the ability to process, analyze, and utilize this data effectively has never been more critical.

Data engineering services have emerged as a vital component in managing this data deluge, ensuring data quality, and enabling financial organizations to extract actionable insights.

Custom software development companies are leading the charge in providing these essential services. They help financial institutions navigate the complexities of modern data environments.

This article explores the rising importance of data engineering services in the financial sector, highlighting their benefits, challenges, and future trends.

What is data engineering?

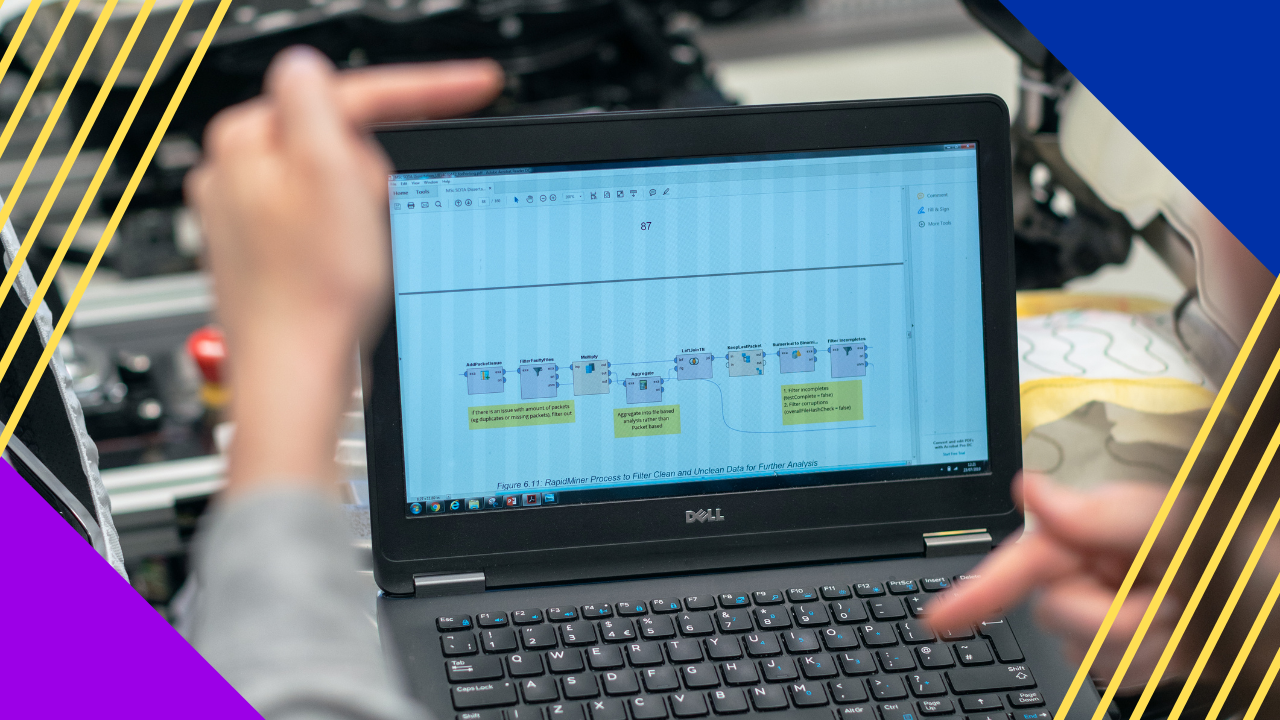

Data engineering involves designing, constructing, and maintaining data pipelines and architectures that allow for the efficient collection, storage, and processing of large volumes of data.

It encompasses a range of activities, including data ingestion, transformation, storage, and retrieval, that aim to ensure that data is reliable, accessible, and usable for analysis and decision-making.

Data engineers work to integrate various data sources, clean and transform information, and ensure that it meets the quality standards required for accurate analytics and reporting.

In the financial sector, data engineering services are crucial for managing the diverse and complex datasets that underpin critical business operations.

Benefits of data engineering services in the financial sector

Data engineering functions support the financial sector in the following ways:

1. Improved data quality and consistency

High-quality data is fundamental to accurate financial analysis and reporting. Data engineering services ensure that data is cleaned, validated, and standardized, eliminating errors and inconsistencies.

By implementing robust data quality frameworks, financial institutions can rely on consistent data across all their systems, enhancing the accuracy of financial models and reports.

2. Enhanced decision-making

Financial institutions rely on data-driven insights to make informed decisions. Data engineering solutions provide the necessary infrastructure to collect and process data from various sources in real-time.

This enables financial analysts and decision-makers to access up-to-date and accurate information, facilitating better decision-making and strategic planning.

3. Effective risk management

Managing risk is a core function in the financial sector. Data engineering helps in aggregating and analyzing data from multiple sources, enabling comprehensive risk assessments.

By leveraging advanced analytics and machine learning models, financial institutions can predict potential risks, identify trends, and develop proactive risk mitigation strategies.

4. Regulatory compliance

Compliance with regulatory requirements is essential for financial institutions to avoid penalties and maintain their reputation.

Data engineering services automate the collection, processing, and reporting of compliance-related data. This ensures timely and accurate reporting, reduces the risk of non-compliance, and simplifies the audit process.

5. Operational efficiency

Data engineering operations streamline data workflows, automating repetitive and time-consuming tasks. This improves operational efficiency by freeing up resources to focus on strategic initiatives.

Optimized data pipelines reduce processing times and enhance the overall productivity of financial operations, leading to cost savings and better resource allocation.

Challenges of data engineering services in financial sector

It’s important to note that while data engineering offers numerous advantages, if not implemented correctly, it can lead to the following drawbacks:

1. Data security and privacy

Ensuring the security and privacy of sensitive financial data is a significant challenge. Financial institutions must comply with stringent data protection regulations and safeguard against cyber threats.

Implementing robust security measures and maintaining data privacy while enabling seamless data access and processing is a complex task for data engineering services.

2. Integration of diverse data sources

Financial institutions deal with data from various sources, including transactional data, market data, and customer information. Integrating these diverse data sources into a cohesive data architecture can be challenging.

Data engineering functions must ensure seamless integration while maintaining data quality and consistency.

3. Scalability

As financial institutions grow, their data volumes increase exponentially. Scaling data engineering solutions to handle large and complex datasets without compromising performance is a major challenge.

Data engineering services must design scalable architectures that can accommodate future data growth and evolving business needs.

4. Talent shortage

There is a significant demand for skilled data engineers in the financial sector. Finding and retaining professionals with the necessary expertise in data engineering, cloud technologies, and advanced analytics is a challenge.

Financial institutions must invest in training and development to bridge the talent gap and ensure that their employees have the required skills to manage their data engineering needs.

5. Keeping up with technological advancements

The field of data engineering is continuously evolving with new tools, technologies, and methodologies.

Staying up-to-date with these advancements and implementing the latest best practices can be challenging for financial institutions.

Data engineering services must ensure that they leverage cutting-edge technologies to provide the best possible solutions to their clients.

Future trends in data engineering services for financial sector

To remain relevant, businesses in the financial sector must stay current with the latest trends. Here are key considerations to help firms enhance their competitive edge:

1. Cloud-based data engineering

The adoption of cloud technologies is revolutionizing data engineering in the financial sector. Cloud-based data engineering services offer:

- Scalability

- Flexibility

- Cost-efficiency

They enable financial institutions to store and process large volumes of data without the need for significant on-premises infrastructure investments.

2. Advanced analytics and machine learning

Integrating advanced analytics and machine learning into data engineering workflows is becoming increasingly important. These technologies enable financial institutions to:

- Gain deeper insights from their data

- Predict future trends

- Automate decision-making processes

Data engineering services will continue to evolve to support advanced analytics and machine learning capabilities.

3. Real-time data processing

Real-time data processing is crucial for making timely and informed decisions in the financial sector.

Data engineering is focused on developing real-time data pipelines that can handle streaming data from various sources. This allows financial institutions to respond quickly to market changes and emerging risks.

4. Data governance and compliance

With increasing regulatory scrutiny, data governance and compliance are becoming critical aspects of data engineering.

Future data engineering services will emphasize robust data governance frameworks to ensure data integrity, security, and compliance with regulatory requirements. This includes implementing data lineage, data cataloging, and auditing capabilities.

5. AI-driven data engineering

Artificial intelligence (AI) is set to transform data engineering by automating complex data processing tasks.

AI-driven data engineering services can enhance data quality, automate data integration, and optimize data pipelines.

This will enable financial institutions to leverage AI for more efficient and effective data management.

| Future Trend | Description |

|---|---|

| Cloud-based data engineering | Offers scalability, flexibility, and cost-efficiency by leveraging cloud technologies for data storage and processing. |

| Advanced analytics and machine learning | Integrates advanced analytics and machine learning to gain deeper insights and automate decision-making processes. |

| Real-time data processing | Focuses on developing real-time data pipelines to handle streaming data for timely and informed decision-making. |

| Data governance and compliance | Emphasizes robust data governance frameworks to ensure data integrity, security, and compliance with regulatory requirements. |

| AI-driven data engineering | It uses artificial intelligence to automate complex data processing tasks, enhance data quality, and optimize data pipelines. |

Transformative power of data engineering in the financial sector

The financial sector is undergoing a transformative shift driven by the increasing importance of data.

Data engineering services are at the heart of this revolution, enabling financial institutions to harness the power of their data for:

- Improved decision-making

- Risk management

- Operational efficiency

Despite the challenges, the benefits of data engineering services are undeniable. They offer enhanced data quality, regulatory compliance, and personalized customer experiences.

Future trends such as cloud-based data engineering, advanced analytics, real-time data processing, robust data governance, and AI-driven data engineering will continue to shape the financial sector’s landscape.

Leading third-party service providers provide cutting-edge data engineering services that help financial institutions navigate these trends and unlock the full potential of their data.

Investing in data engineering services is essential for financial institutions to stay competitive and innovative in today’s data-driven world.

By leveraging the expertise of data engineering professionals, financial organizations can turn their data into a strategic asset, driving growth, efficiency, and long-term success.

Independent

Independent