Decoding Form 1095-C

Employers can submit Form 1095-C, a government form, to provide information about the health insurance plans they offer to their workforce.

Additionally, this form attests to the businesses’ adherence to the Affordable Care Act in the US. They avoid possible tax penalties while accurately reporting their coverage.

What is Form 1095-C?

Form 1095-C, or Employer-provided health insurance offer and coverage, is sent to employees by their employer to complete their tax returns.

The form includes details about the health insurance coverage offered by the employer, such as the months it was available and the employee’s premium cost share.

When filing taxes, individuals use Form 1095-C to confirm their health coverage throughout the year. This document helps the IRS (Internal Revenue Service) verify that individuals meet the healthcare requirements.

Who needs to file Form 1095-C?

A large company with 50 or more full-time employees must give you Form 1095-C.

Employers use it to report the health insurance offer, its affordability, and the employees who accepted or declined it.

Small businesses with fewer than 50 employees are generally exempt from filing Form 1095-C.

Employees do not file this form. But they need it to complete their individual tax returns. Even if you did not have coverage for the entire year, filing the form is still necessary. It helps the government track who has health insurance.

Connection to the Affordable Care Act (ACA)

The Affordable Care Act (ACA), or Obamacare, is a law in the United States focused on making healthcare more accessible and affordable for everyone. It was enacted in 2010 and includes various provisions to improve the healthcare system.

The goal is for more people to access quality healthcare without the financial barriers for a healthier population overall.

The ACA mandates that large employers provide their full-time employees with affordable, comprehensive health insurance options.

Form 1095-C is vital in the ACA’s strategy to track and enforce employer-provided health insurance coverage. It promotes broader access to healthcare for individuals.

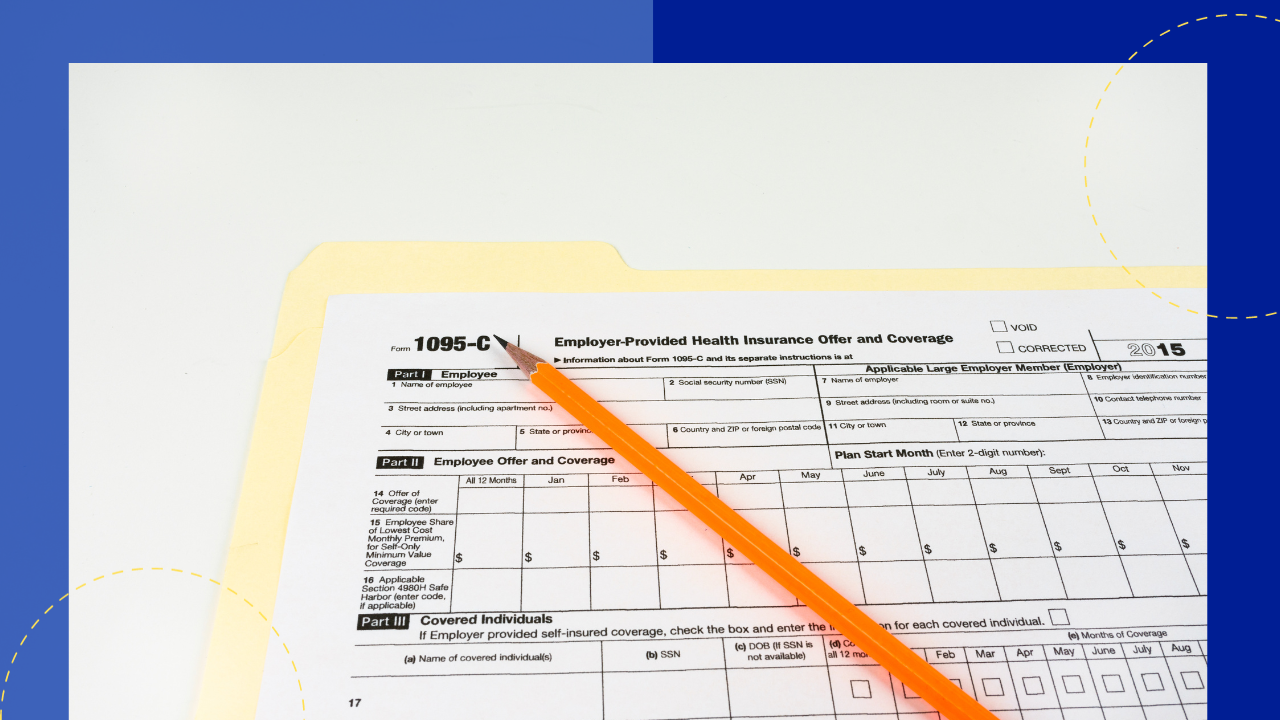

Sections of Form 1095-C

Form 1095-C ensures transparency and compliance with the Affordable Care Act so the following sections are made.

Section I: Employee and employer information

This part of the form collects basic details about the employee and employer. It has the names, addresses, and employer identification numbers.

This section must identify who is covered and who provides the coverage.

Section II: Offer and coverage details

In this section, employers outline the health insurance options offered to their employees. This includes the type of coverage available, the months it was shown, and the employee’s share of the lowest-cost monthly premium.

Section III: Covered Individuals

It captures the names and social security numbers of the employee, spouse, and dependents. This section aids in tracking who benefited from the health coverage throughout the year.

It identifies who in the employee’s family availed the insurance and for which months.

The ACA and Form 1095-C

The ACA puts value on accurately reporting healthcare coverage. This is where Form 1095-C contributes. It serves as a critical document to support the larger ACA framework.

ACA’s role in healthcare reporting

Besides expanding Medicaid and establishing health insurance marketplaces, the ACA introduced employer reporting requirements.

They ensure individuals give the necessary information to comply with the individual mandate and claim premium tax credits.

Penalties for non-compliance and inaccuracies

Employers who do not offer coverage or who do so but do not comply with ACA requirements will be subject to fines. Additionally, incomplete or inaccurate information on the forms may result in penalties.

To avoid further financial penalties, employers must ensure that the information they report on Form 1095-C is accurate.

How Form 1095-C fits into the larger ACA framework

The form serves both employers’ and employees’ needs.

Employers can use it as proof of ACA compliance regarding reporting requirements. They can fulfill their responsibilities by providing accurate and timely information.

Employees get the paperwork they need to file taxes and, if qualified, claim premium tax credits.

Common mistakes and how to avoid them

When completing Form 1095-C, errors may happen. These can be mistakes made accidentally or purposively, which will cause problems with compliance.

Overlooking changes in employee status

Employees transition between full-time, part-time, or seasonal positions. This transition impacts their eligibility for health coverage. Employers must stay vigilant and consistently update the form to reflect sudden changes.

Misinterpreting coverage codes

Misinterpreting these codes can result in misinformation about the type and affordability of coverage offered to employees. Diligence helps avoid confusion for both employees and regulatory authorities regarding coverage codes.

Failing to provide accurate data in a timely manner

The kind and cost of health insurance provided to employees are ascertained by the IRS using particular codes.

If these codes are mislabeled, it may cause misunderstandings and IRS inquiries. Employers should take the time to become familiar with each coverage code and use caution when allocating them.

Independent

Independent