OA500: Analysis of the world’s top 500 outsourcing firms

With double-digit growth, outsourcing will play a key role in global economic growth by 2030. The Time Doctor OA500 provides analysis of the top 500 firms leading this charge.

An analysis of the world’s top 500 outsourcing companies shows the outsourcing industry is a key contributor to economic growth globally, with small and medium-sized outsourcing firms leading the way.

Outsourcing interest from businesses saw a significant jump in the first month of 2023 alone.

The Outsourcing Performance Report from Outsource Accelerator’s Source Partner platform shows there were 1,684 inbound inquiries from 49 countries and 27 sectors in January — which is 15% higher than the previous month.

This data indicates that outsourcing continues to be an attractive option for businesses across the globe, and outsourcing firms can expect to see continued growth in the future.

Outsourcing growth is driven by SMEs

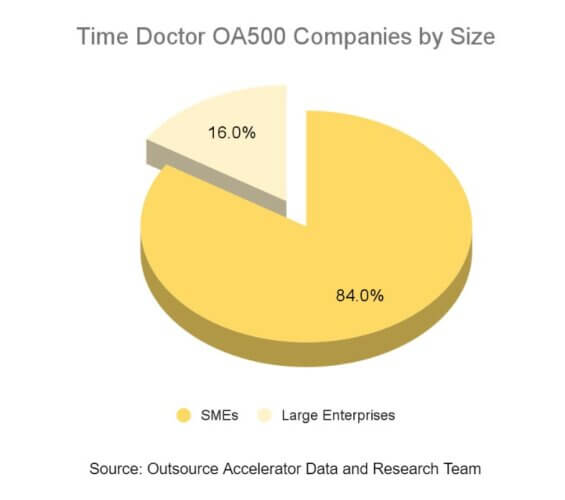

The OA500 index, which ranks outsourcing providers based on prominence, shows there are 420 outsourcing-related small and medium-sized enterprises (SMEs) or companies with less than 5,000 employees.

According to the World Bank, formal SMEs represent about 90% of all businesses and more than 50% of employment worldwide. With 84% of Time Doctor OA500 companies considered SMEs, Outsource Accelerator sees the new and emerging outsourcing firms as major contributors to the industry’s overall revenue and the global economy in general.

Overall, the top 500 firms generated an estimated revenue of US$442.62 billion, which is 89% of the total revenues of all outsourcing firms in the Global Outsourcing Firm (BPO) Index. It is worth noting that many of the largest outsourcing firms are conglomerates with multiple lines of business, so it is difficult to identify what proportion of their revenue specifically comes from outsourcing services.

It is also unclear exactly how big the outsourcing industry actually is. A report by Grand View Research says the global business process outsourcing market size was valued at US$261.9 billion in 2022. There are also the IT outsourcing and shared services sectors to consider.

Thriving global outsourcing industry

A closer look at the Top 20 companies in The Time Doctor OA500 index revealed a huge outsourcing footprint in the United States.

Outsourcing firms whose headquarters are located in the United States dominate the Top 20, with an estimated total revenue of US$36 billion.

Other countries serving as home to the other Top 20 firms include India, France, Ireland, Germany, Canada, China, and United Kingdom.

However, since outsourcing firms are truly global organizations, the formal headquarters does not typically represent the true presence of the company.

Large outsourcing firms can have hundreds of thousands of staff placed across dozens of countries – with the vast majority of their staff and operations based in emerging economies.

| Rank | Company | Headquarters |

|---|---|---|

| 1 | Accenture | Ireland |

| 2 | Teleperformance | France |

| 3 | Wipro | India |

| 4 | Siemens | Germany |

| 5 | Cognizant | United States |

| 6 | Capgemini | France |

| 7 | Emerson | United States |

| 8 | Infosys | India |

| 9 | HCL | India |

| 10 | CGI | Canada |

| 11 | Tech Mahindra | India |

| 12 | Concentrix | United States |

| 13 | Neusoft | China |

| 14 | Teletech | United States |

| 15 | Serco | United Kingdom |

| 16 | Sykes | United States |

| 17 | TaskUs | United States |

| 18 | Virtusa | United States |

| 19 | Capita | United Kingdom |

| 20 | Genpact | United States |

Source: Outsource Accelerator Data and Research Team

The oldest and youngest

Interestingly, the oldest outsourcing firm on the OA500 list is Williams Lea, which was founded in 1820.

It is one of three 19th-century companies on the list, with the others being Arvato and Emerson, which were founded in 1835 and 1890, respectively.

On the other hand, the newest entity on the Time Doctor OA500 list is Alvaria, which was established in 2021. Despite its recent start, Alvaria’s revenue is estimated at US$1 billion.

Although a new company, Alvaria is actually a merger between Aspect Software and Noble Systems, two companies that have been in existence for 50 years. This demonstrates the importance of strategic partnerships and collaborations in the outsourcing industry.

In 2022 alone, a total of 172 mergers and acquisitions happened within the outsourcing industry. 65 outsourcing companies were acquired, while 107 outsourcing companies acquired other companies.

| Outsourcing Companies | Acquisitions (2022) |

| Acquiree | 65 |

| Acquirer | 107 |

| Total | 172 |

Source: Crunchbase

With the global business process outsourcing market forecasted to expand at a compound annual growth rate (CAGR) of 9.4% in seven years, Outsource Accelerator expects the Time Doctor OA500 firms to become the world’s top employers by 2030.

Independent

Independent