We all know that there are additional costs and taxes, but most are oblivious to the exact cost. And it is staggering. In fact, 90% of businesses are blissfully unaware of the true costs of employing someone.

Businesses are under pressure right now, with rampant inflation and soaring salaries. Sadly, the basic salary number is just the tip of the iceberg.

The actual cost of employment can reach 100% on top of the base salary.

Obvious things include government taxes, health insurance, and bonuses. The less obvious include holidays and sick leave, onboarding, training, retention, and software subscriptions.

The stealth costs of recruitment services and the office, hardware, and facilities are often overlooked – but super expensive. Then, you have the HR department that makes all of this happen – which also comes at a cost.

It’s no wonder that total employment costs far exceed the salary.

Humans are expensive!

Offshore staff also incur similar overhead costs. Even though they are sitting offshore, they are similarly protected by local labor laws and subject to taxes, etc. And this is fantastic!

However, offshore salaries are typically 70% cheaper – meaning that typical employment overheads are also about 70% cheaper.

So a US-based employee with a $100k salary might have a total cost of $200k. In comparison, a similarly capable person in the Philippines might have a salary of $30k, with a total cost of $60k.

The ratios are still the same, but the total cost is $200k versus $60k. You stand to save $140k – for the same person!

Don’t believe me?

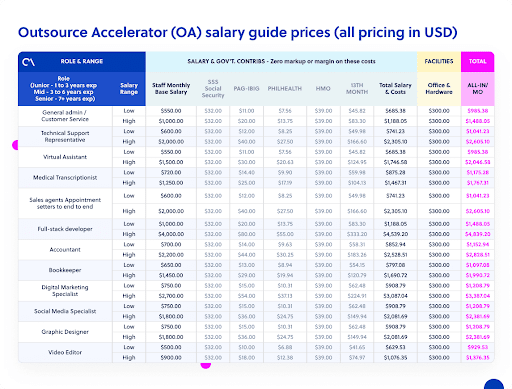

The table below breaks down the true, complete costs of employing someone in the Philippines. Note: this is the cost only and does allow for any margin that might go to an offshoring firm.

As the world heads into tougher economic times, thousands of businesses are finding new ways to drop costs and source great staff.

The question for your business:

What are the real, all-in costs of your team?

Independent

Independent