Coronavirus FAQ & Updates – Business & Legal

Coronavirus Business Recovery Action Plan

UPDATE: Coronavirus (COVID-19) is forcing a lot of companies to review their traditional staffing, offshore, and Work-From-Home (WFH) options. Outsourcing enables businesses to slash costs whilst at the same time maintain and rebuild their companies. If you’re a business owner exploring, or already outsourcing:

>>> Read the Coronavirus Business Recovery Action Plan

Coronavirus FAQ Notes

- This guide was made by volunteer members of the Filipino Legal Community

- Version 3 (19 March 2020, 10:22p.m) – see edits

- Bookmark & revisit this page for further updates

- Please share with your community

- Instigated and coordinated by Rocky Chan

- [PODCAST] COVID-19 & BPO Outsourcing – Business Risk Analysis

- [PODCAST] Interview with WHO on COVID-19 & BPO Industry

- [GUIDE] COVID-19 Business Recovery Action Plan

- [COVID GCQ UPDATE] Back to work: what PH employers and employees need to know

- Subscribe to OA NewsHub for all BPO industry updates: subscribe here

- Queries, comments and updates c/o: [email protected]

Coronavirus FAQ Content

- A. Overview and Updates

- B. FAQs on Freedom to Travel

- 1. What does “Community Quarantine” mean?

- 2. Who determines whether an area is under General or Enhanced Community Quarantine?

- 3. What is a State of Calamity?

- 3. Can I still go out?

- 4. What is Social Distancing?

- 5. Can I leave town? Go abroad?

- 6. What are the rules for those who have been identified as COVID-19 PUIs or PUMs?

- C. FAQs for Employers & Employees

- 1. Am I allowed to operate my business during this time? What are to remain open during the Enhanced Community Quarantine

- 2. I work in a BPO or Export-oriented company, how can I report to work if all public transportation companies are not operating?

- 3. What are the options available for my business during this community quarantine?

- 4. What are the “flexible working arrangements”?

- 5. What is CAMP?

- 6. Who are the affected workers?

- 7. My company is interested in CAMP, how do I avail of it?

- 8. Am I required to implement flexible working arrangements? What if my employees are demanding it?

- 9. What is the process for going about and implementing flexible working arrangements?

- 10. What are the forms needed to file with DOLE?

- 11. Do we need to pay employees if they are put on forced leave?

- 12. Small business owner – position on employees with lockdown

- 13. How does this affect computation of 13th month pay?

- 14. Luzon is now under Enhanced Community Quarantine. Will my employees be allowed to travel to and from home to work?

- 15. Are freelance/self-employed workers covered by the curfew and community quarantine? What documents would you need to pass through checkpoints?

- 16. Are there cash loan facilities that can be availed of to tide employees over during this no-work, no-pay period?

- 17. Are there available benefits for workers affected by Covid-induced layoffs and closures?

- D. FAQs on Business

- 1. Can I remain open for business?

- 2. I own a restaurant/ catering service. Can I remain open?

- 3. What is Force Majeure and how does this affect my contracts?

- 4. What are the examples of situations when the law makes a person liable even if there is force majeure?

- 5. May we stipulate in the contract in advance that parties will be liable even if there is force majeure?

- 6. So what does this all mean for the contracts I have?

- 7. What if my goods are in transit through Metro Manila i.e Business in Bulacan and Customer in Cavite?

- 8. Do I still need to continue paying mandatory SSS contributions during this period?

- 9. Do we still pay rent during the community quarantine?

- E. FAQs for Government Offices and Services

- 1. What Government Offices will be open in the coming days and what services will they provide?

- 2. Will BIR adjust its deadlines?

- 3. How will the filing of AITR be done?

- 4. What are the mandatory disclosure requirements for companies?

- 5. Government Extensions

- 6. Are the payments of utilities (water, electricity, etc) and bank amortizations suspended during this period?

- F. FAQs on Privacy in Reporting of Personal Data for Contact Tracing Purposes

- 1. What type of information can be collected for contact tracing purposes?

- 2. What considerations should be applied in disclosing personal information of PUIs and PUMs?

- 3. Is there basis for the collection of the name and travel history of PUIs and PUMs, even without their consent?

- 4. Is there basis for the collection of the medical history of PUIs, even without my consent?

- 5. Who can process personal data for contact tracing purposes?

- 6. What should an employer do in case government officials request for the identity and other personal information of employees who are PUIs?

- 7. What are prohibited acts of PUIs/PUMs in relation to the reporting of information for contact tracing purposes?

- G. Coronavirus Government Directory

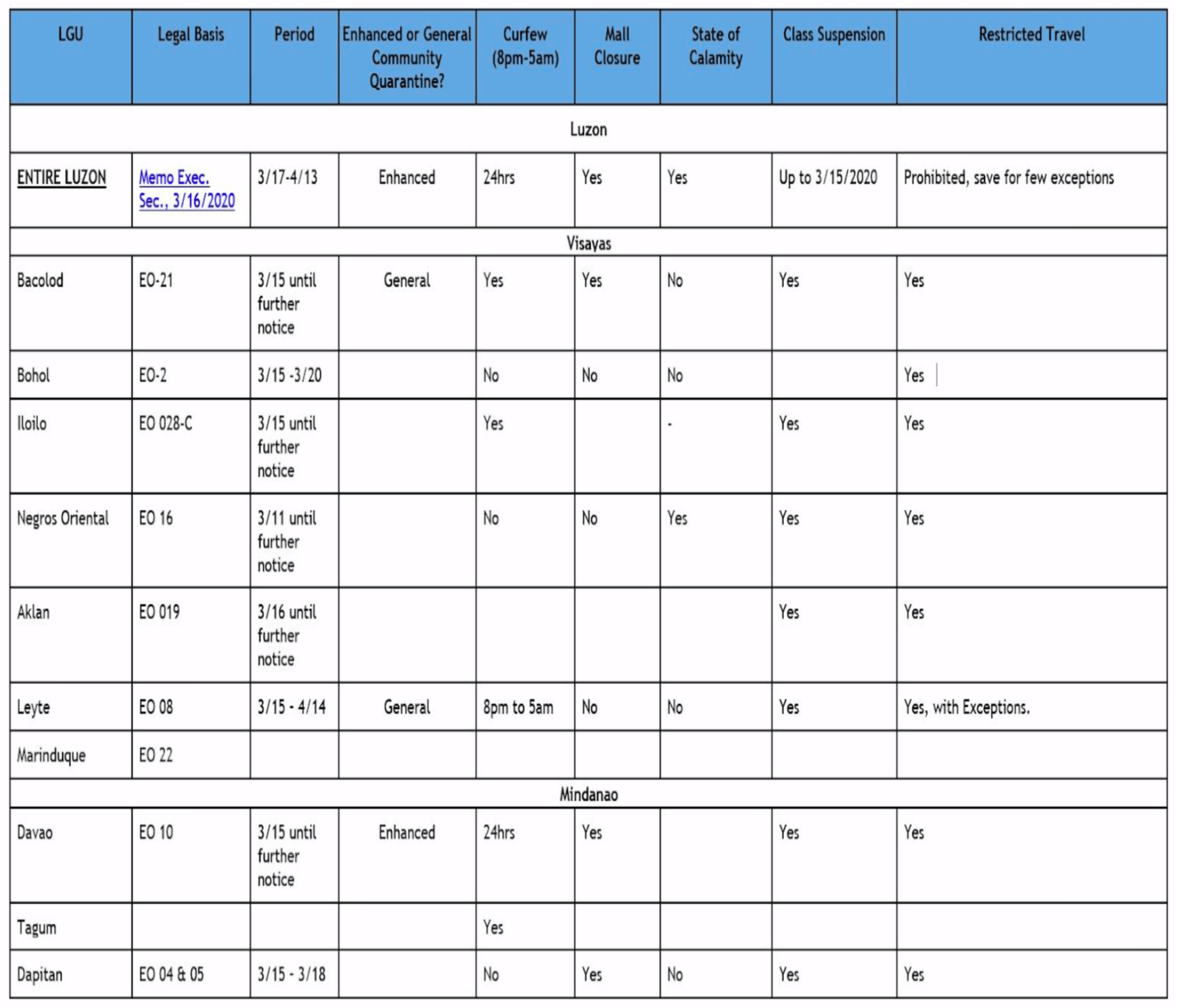

- H. Annex: Table of LGU Regulations

- I. Coronavirus FAQ Contributors

A. Overview and Updates

Life in the time of Coronavirus is uncertain, but hopefully, the volunteers in this group can shed a little light on the murkier aspects of our new day-to-day brought about by the virus. Because life does go on.

A few things to note:

- As the situation is still fluid, with more information coming by the day, we hope that this will be an evolving document, and we will strive to release updates as new information or questions arrive.

- While we will bring the best of our knowledge and expertise to the answers given here, this document aims to point the reader in the right direction and is in no way a substitute for actual legal advice.

To start, here are a few useful resources:

- DOH COVID-19 Tracker – https://ncovtracker.doh.gov.ph/

- Global COVID-19 Tracker – https://www.worldometers.info/coronavirus/

- Various Government Issuances (will endeavor to update folder regularly)-

https://drive.google.com/drive/folders/1dbRT4iMStLHFOtwuLiKtOfR3WpiwIetQ?usp=sharing

What’s New in Version 2.1:

- General Revision: all FAQs in light of the 16 March 2020 declaration of Luzon as being under ENHANCED COMMUNITY QUARANTINE.

- Updated: of Government Offices business schedules.

- Clarification: BIR ITR payments.

- Added: Table on government filing extensions.

- Added: Table on private companies giving relief from payments

- Added: FAQs on Privacy in Reporting of Personal Data for Contact Tracing Purposes

- Added: Table on measures taken by individual LGUs Nationwide

What’s New in Version 3:

- General Revision: all FAQs in light of Proclamation 929; DOLE, Additional Guidelines for the Community Quarantine by the IATF dated 18 March 2020; DOLE Department Order 209 )

- Updated: Table on private companies giving relief from payments

- Updated: New Annual Income Tax filing deadline, in light of Revenue Memorandum Circular Nos.28-2020 and 29-2020

- Added: Coronavirus Hotline Numbers

Please stay safe, everyone!

Your Coronavirus FAQ Project volunteers.

B. FAQs on Freedom to Travel

1. What does “Community Quarantine” mean?

It is defined as follows:

- GENERAL COMMUNITY QUARANTINE – where the movement of people shall be limited to accessing necessities and work; and uniformed personnel and quarantine officers shall be present at border points

- ENHANCED COMMUNITY QUARANTINE – where strict home quarantine shall be implemented in all households; transportation shall be suspended; provision for food and essential health services shall be regulated; heightened presence of uniformed personnel to enforce quarantine procedures will be implemented. (par. 3, Memorandum from the Executive Secretary re: Stringent Social Distancing Measures and Further Guidelines for the Management of the Coronavirus Disease 2019 Situation [“SSDM”])

2. Who determines whether an area is under General or Enhanced Community Quarantine?

The LGU, taking into consideration the directives of the Department of Health (DOH) and the Department of Interior and Local Government (DILG) (par. 3, SSDM). As of 16 March 2020, the President has placed Luzon under an Enhanced Community Quarantine beginning 17 March 2020 to 12:00 a.m. of 13 April 2020. (Memorandum from Executive Secretary dated 16 March 2020)

3. What is a State of Calamity?

A State of Calamity is “a condition involving mass casualty and/or major damages to the environment, property, infrastructures, disruption of means of livelihoods and businesses, and normal way of life of people in the affected areas as a result of the occurrence of a natural or human-induced hazard. (NDRRMC Memorandum Order No. 60 – 2019)

On 16 March 2020, the President, through Proclamation No. 929, declared a State of Calamity throughout the entire country.

What this means is that the President can exercise extraordinary powers to release funds, and call for other measures during this period to lessen the effects of the calamity. These include, among others:

- To impose a price ceiling on basic necessities and prime commodities;

- Monitor and prevent profiteering and hoarding of prime commodities;

- Programming funds for the repair or upgrading of infrastructure;

- To grant no-interest loans;

- Utilize funds within affected LGUs.

A declaration of a State of Calamity is not a declaration of Martial Law. It does not suspend any rights of the citizens nor does it grant any of the extraordinary powers that come with a declaration of Martial Law to the executive.

4. Can I still go out?

No, save for certain exceptions. Stay at home.

The general rule is that a strict home quarantine shall be observed in all households; movement shall be limited to accessing basic necessities; provision for food and essential health services shall be regulated; and there will be heightened presence of uniformed personnel to enforce quarantine procedures.

Exceptions:

- Only 1 (one) person per household is allowed to go outside their homes to buy basic necessities. Use of private vehicles for this purpose shall be allowed. You may also choose to walk;

- Media vehicles and reporters shall be allowed to travel within the community quarantine area, provided that they secure a special media pass from the PCOO;

- Land, air and sea travel of uniformed personnel for official business, especially those transporting medical supplies, laboratory specimens related to the Coronavirus, and other humanitarian assistance, shall be allowed.

- Heads of mission or their designated foreign mission representatives, including limited foreign mission personnel may be exempted from the quarantine whenever performing diplomatic functions.

- The following shall be allowed until end of 20 March 2020:

- Transfer of necessary equipment of BPO and export-oriented establishments to facilitate work from home arrangements; and

- BPOs and export-oriented establishments to make arrangements with hotels for basic lodging.

*For purposes of the above, personnel of BPOs and export-oriented enterprises shall be allowed to travel, subject to presentation of proof of employment, address of employer and residence.

Mass public transport facilities shall be suspended. No rail (MRT, LRT, PNR) no buses, jeepneys, taxis, TNVS (Grab, Angkas), FX, UV Express, and P2P buses will be operational

Mass gatherings are PROHIBITED. A mass gathering is a planned or spontaneous event where the number of people attending the event could strain the planning and response resources of the LGU where the event will be held. It includes movie screenings, concerts, sporting events and other entertainment activities, community assemblies and non-essential work related gatherings.

(Sources: Memorandum from Executive Secretary dated 16 March 2020; DOTr Advisory)

5. What is Social Distancing?

Maintenance of a distance of at least one (1) meter radius between and among people attending events. (par. 2., SSDM)

6. Can I leave town? Go abroad?

- a. DOMESTIC TRAVEL – No, see above;

- b. INTERNATIONAL TRAVEL – A irport operation shall be limited to outgoing flights carrying foreigners and tourists. Filipinos are not allowed to go outside the country; Inbound flights will only be for repatriating Filipinos.

(Par. 5, DOTr Advisory)

7. What are the rules for those who have been identified as COVID-19 PUIs or PUMs?

Persons Under Investigation (PUI) (i.e., those with travel history, or have been in the same close environment with a Coronavirus patient and have exhibited mild symptoms) must be immediately admitted to the designated Coronavirus isolation while hospital staff, in proper protective equipment, will take swabs for testing.

Persons Under Monitoring (PUM) (i.e., asymptomatic patients with appropriate exposure history) are advised to:

- Inform the DOH’s Regional Epidemiology and Surveillance Unit (RESU) by submitting the Case Investigation Form (CIF);

- Consult with the nearest health facility once they are showing any symptoms;

- Undergo a 14-day home quarantine; and

- Secure certification from the City/Municipal Health Officer proving that they completed the 14-day quarantine.

C. FAQs for Employers & Employees

1. Am I allowed to operate my business during this time? What are to remain open during the Enhanced Community Quarantine?

General Rule: No, the purpose of the enhanced community quarantine is to limit the movement and interaction of individuals, including the transportation to and from the workplace.

Businesses which are allowed to operate:

- (1) Those that provide basic necessities and such activities related to food and medicine production:

- Public Markets

- Supermarkets

- Groceries

- Convenience Stores

- Hospitals

- Medical Clinics

- Pharmacies and Drugstores

- Food Preparation and Delivery Services

- Water Refilling Stations

- Manufacturing and Processing Plants of Basic Food Products and

- Medicines

- Banks

- Money Transfer Services

- Power and Energy

- Water Companies

- Telecommunications Supplies and Facilities

- (2) Business Process Outsourcing

- (3) Export Oriented Industries

*For Nos. 1-3 above, employers must ensure that:

- Skeletal Workforce shall be implemented

- Strict Social Distancing Measures are observed

- (4) Media Companies

- (5) Transportation

- a) Air Travel

- i) To service outbound passengers intending to depart the Philippines from any of the international airports in Luzon. A period of seventy-two hours commencing at 12:00 AM midnight on March 17, 2020 and ending at midnight March 20, 2020

- ii) To transport inbound international passengers

- b) Land and Sea

- i) To transport uniformed personnel for official business, especially those transporting medical supplies, laboratory specimens related to Coronavirus, and humanitarian assistance, shall be allowed.

- c) Cargo

- a) Air Travel

- (6) Those that have implemented a “Telecommuting/Work from Home” scheme with their employees

- (7) Hotels or similar establishments, but only the following:

- a) Foreign guests who have existing booking accommodations as of March 17, 2020;

- b) Guests with long term leases; and

- c) Employees from exempted establishments under the provisions of the 16 March 2020 Memorandum (e.g. BPOs, healthcare workers, etc.)

- NOTE: POGOS ARE NOT ALLOWED TO OPERATE

(Sources: Memorandum from Executive Secretary dated 16 March 2020; Additional Guidelines for the Community Quarantine by the IATF dated 18 March 2020 )

2. I work in a BPO or Export-oriented company, how can I report to work if all public transportation companies are not operating?

For those in Business Process Outsourcing and Export Oriented Industries, the skeletal personnel must be provided temporary housing arrangements by the employer. Such temporary accommodation arrangements must be provided by March 18, 2020.

Hence, you can approach your employer once assigned as skeletal personnel and request for temporary housing arrangements.

( Sources: Memorandum from Executive Secretary dated 16 March 2020)

3. What are the options available for my business during this community quarantine?

Given the limited mobility of employees, suppliers and customers, it is inevitable that business will suffer a loss in revenue. Hence, aside from outright termination of workers or total closure of establishments, the DOLE through Labor Advisories Nos. 9 and 11, provided guidelines on opting for “flexible working arrangements” as a better alternative to the above choices.

Link to DOLE Labor advisory for easy reference:

● Labor Advisory 09-20 “Guidelines on the Implementation of Flexible Work Arrangements as Remedial Measure due to the Ongoing Outbreak of Coronavirus Disease 2019 (COVID-19)

● Labor Advisory 11-20 (page 2 here) “Supplemental Guidelines Relative to Remedial Measures in View of the Ongoing Outbreak of Coronavirus Disease 2019 (COVID-19)

In addition, DOLE also introduced the COVID-19 Adjustment Measures Program (“CAMP”) for affected workers, allowing companies to avail of financial assistance for their employees (Source: DO 209 dated 17 March 2020)

4. What are the “flexible working arrangements”?

Flexible work arrangements, which are temporary, refer to alternative arrangements or schedules other than the traditional or standard work hours, workdays, and workweek.

It is one of the coping mechanisms and remedial measures in times of economic difficulties and national emergencies and is recognized as beneficial in terms of reducing business costs and saving jobs while maintaining competitiveness and productivity in industries.

Examples are the ff:

- Telecommuting/work from home – work arrangement in which the employee renders remote work, often working from home

- Reduction of workdays or work hours – normal workhours or workdays are reduced i.e 4-day workweek

- Rotation of workers – employees are rotated or alternately provided work within the week i.e employees are split into 2 shifts. 1 shift works M-W-F, another shift works T-TH-S

- Implementation of forced leaves – employees are required to go on leave for several days or weeks utilizing their leave credits if there are any.

Flexible working arrangements are not limited to these modes since DOLE encourages employers and employees to explore other flexible work arrangements to cushion the effect of loss of income of employees.

5. What is CAMP?

Under DOLE DO 209, CAMP is a safety net program that offers financial support to affected workers in private establishments that have adopted Flexible Working Arrangements (FWA) or temporary closure during the Coronavirus pandemic.

Under this program, a one-time financial assistance equivalent to PHP 5,000 shall be provided to affected workers in lump-sum, non-conditional, regardless of employment status.

6. Who are the affected workers?

Affected workers are those in private establishments that suffer or face interruption due to the Coronavirus pandemic including:

- Those whose employment is temporarily suspended by reason of suspension of operations

- Those whose regular hours are reduced and therefore, regular wages are reduced due to the implementation of FWA’s as mitigating measures

Government employees are not affected workers as they do not now work in private establishments. Hence, they are excluded from the program.

7. My company is interested in CAMP, how do I avail of it?

- (a. )Applications with complete documentary requirements shall be submitted online to the appropriate DOLE Regional Office or any of its provincial/field offices. Email addresses listed here

- (b.) Documentary requirements are the following:

- (i.) Establishment Report (download here) pursuant to Labor Advisory Nos. 9-2020 and 11-2020

- (ii.) Company payroll for the month prior to the implementation of FWA or temporary closure

- (c.) Applications shall be evaluated by concerned DOLE Regional Office within

three working days from receipt thereof. - (d.) The following depending on the status of evaluation shall be issued to the

applicant by the concerned DOLE Regional Office within three working days

through email:- (i.) For approved application: Notice of Approval

- (ii.) For denied application: Notice of denial

8. Am I required to implement flexible working arrangements? What if my employees are demanding it?

DOLE recommends and encourages the implementation of flexible working arrangements, but leaves it to the discretion of the employers whether to implement it or not. It is not demandable on the part of the employees. It is also not the responsibility of the employer to provide the tools with which the employees can work from home, e.g. strong internet connection, electricity, utilities, etc.

However, while not mandatory, this is something for employers to consider in crafting their respective business continuity measures.

9. What is the process of going about and implementing flexible working arrangements?

- Employers and employees meet to explore adopting flexible working arrangements to cushion and mitigate the effect of the loss of income.

- Publish a copy of Labor Advisory No. 9, 2020 in a conspicuous location in the workplace

- Notify DOLE through the Regional/Provincial/Field Office which has jurisdiction over the workplace using the Establishment Report Form on COVID – 19 (“Report Form”) to the employers’ respective DOLE Regional/Provincial/Field Offices having jurisdiction over their businesses.

- For Flexible Work Arrangements, employers are required to submit to DOLE at least one (1) week before implementation. Given the current circumstances, we advise employers to still comply with the notification even if the arrangement has already been implemented or the one (1)-week notice proves to be too prejudicial. Likewise, indicate in the Notice to DOLE the justifiable reason why the one (1)-week notice period cannot be complied with.

10. What are the forms needed to file with DOLE?

Fill out an Establishment Report (download here)

11. Do we need to pay employees if they are put on forced leave?

No. Under the principle of no work, no pay. However, leaves of absences of employees during the community quarantine period shall be charged against the workers’ existing leave credits. The remaining unpaid leaves during the quarantine period may be covered and subject to conditions provided in the proposed COVID-19 Adjustment Measures Program (CAMP).

As of this date, no details on this program have emerged. Note that in normal circumstances, a “forced leave” without pay is not generally allowed by the law, however, these are special circumstances and the DOLE expressly granted the same through their recent issuances.

We encourage employers to exercise such discretion on the formulation and implementation of the arrangements, in utmost good faith, by taking into consideration the Guidelines’ purpose to mitigate the

employees’ loss of income, as well.

However, this does not prevent you from taking the initiative and paying your employees nonetheless. This finds basis under the principle of management prerogative which allows employers to implement rules and measures it

deems appropriate for their teams.

12. Small business owner: Employees were advised not to come into work until after lockdown, but employees only have five days of sick leave, and SBO does not want to eat into their holiday leave. If SBO gives them half a month’s pay for the lockdown, will this be compliant with labour laws?

During the enhanced community quarantine, the grant of half-month’s pay for the lockdown is largely dependent on the discretion of the employer.

Under existing advisories to date, leaves of absences of employees during the community quarantine period shall be charged against the workers’ existing leave credits. If no more leave credits remain, then the principle of no work, no pay applies – the employer does not have to pay its employees who are on forced leave under the current circumstances.

13. How does this affect the computation of 13th-month pay?

As of this writing, no rules are given out by DOLE for any adjustments, but it would be safe to assume that we follow the regular rules for now.

14. Luzon is now under Enhanced Community Quarantine. Will my employees be allowed to travel to and from home to work?

No, save for the establishments listed in Par. No. 1.

If your employees work in the listed establishments that will remain open, you must present proof of employment AND residency in checkpoints, such as:

- Identification Card (ID) containing the Company’s address/place of work AND employee’s place of residence. (It has to be both);

- Certification of Employment (“COE”) issued by the Company which shall state the place of work.

- Proof of residence

15. Are freelance/self-employed workers covered by the curfew and community quarantine? What documents would you need to pass through checkpoints?

See above.

16. Are there cash loan facilities that can be availed of to tide employees over during this no-work, no-pay period?

Pag-IBIG Fund members who reside in areas declared under a state of calamity and are affected by such disasters can avail of the Pag-IBIG Fund Calamity Loan. The loan seeks to provide immediate financial assistance to

help members recover from the effects of such calamity.

It comes at a low-interest rate of 5.95% per annum. The loan is payable within 24 months and has a deferred first payment.

To date, only Quezon City and San Juan have declared a state of calamity.

https://www.pagibigfund.gov.ph/STL_MPL_Calamity.html#calamitylanding

17. Are there available benefits for workers affected by Coronavirus-induced layoffs and closures?

SSS premium-paying members can avail of unemployment benefits equivalent to half of their average monthly salary credit for a maximum of two months. This applies if they are displaced because of redundancy, installation of labour-saving devices, retrenchment, closure or cessation of operation, and disease or illness.

They should have paid the requisite minimum number of monthly contributions for three years to qualify for this unemployment benefit, twelve of which should have been made in the last eighteen months. (Section 14-B, RA 11199;

https://www.pna.gov.ph/articles/1096455; https://www.dof.gov.ph/sss-ready-to-pay-unemployment-benefits-of-workers-affected-by-covid-induced-firm-layoffs-closures/)

D. FAQs on Business

1. Can I remain open for business?

See above. Only those that provide basic necessities and such activities related to food and medicine production are permitted to remain open during the enhanced quarantine period provided that social distancing and other safety and health measures are strictly observed.

The call to remain open is emphasized for businesses that provide essential services such as banks, grocery stores, pharmacies, restaurants with online delivery service, and medical facilities.

2. I own a restaurant/ catering service. Can I remain open?

Yes only for pick-up and delivery. Since movement is restricted, it is best if the restaurant or catering service itself had its own in-house delivery service since GrabFood, FoodPanda are not currently in operation. It is also advised that you have your riders/ drivers bring with them a Certificate from your restaurant or catering service that they are indeed delivering food.

3. What is Force Majeure and how does this affect my contracts?

“Force Majeure”, also known as “fortuitous event” or “acts of God”, refers to events which could not be foreseen, or which, though foreseen, were inevitable. (Civil Code Art 1174). The Coronavirus pandemic is a declared example of force majeure.

Under the law, a case of force majeure generally excuses a person from performing its obligations under a contract, subject to observance of the following: i.) the cause for non-compliance with the obligation must be independent of the will of the person mandated to comply with the obligation; ii.) the event must be either unforeseeable or unavoidable; iii.) the must be such as to render it impossible to fulfill the obligation in a normal manner; and iv.) the person mandated to comply with the obligation must be free from any participation in, or aggravation of the injury to the person to whom the obligation shall be rendered.

There are exceptions though, to the rule that force majeure excuses a person from performing obligations under a contract, such as when the law or a provision of the contract says otherwise, or when the nature of the obligation requires the assumption of risk. (Civil Code 1174)

4. What are the examples of situations when the law makes a person liable even if there is force majeure?

For example, if the person who, under the contract, is liable to deliver something is already in delay even before the fortuitous event occurred, he or she is still responsible for any fortuitous event until he or she delivers. (Civil Code Art 1165)

An example of this is if you were supposed to deliver something prior to the Coronavirus situation, the current situation, at best, will only exempt you from liability for the current period, but you would still be liable for the previous delay.

Furthermore, the person must not be guilty of negligence, otherwise, he or she would still be liable even if there is force majeure. (Tan Chiong vs inchausti, 22 Phil. 152)

5. May we stipulate in the contract in advance that parties will be liable even if there is force majeure?

In advance, yes. Not after the force majeure has taken place unless both parties agree.

6. So what does this all mean for the contracts I have?

At the end of the day, it means that both sides will need to be reasonable. This is a new situation and sitting down with the person on the other side of the contract to renegotiate is highly encouraged.

The general rule is that the force majeure event must actually prevent one or both parties from performing their side of the contract, whether partially or wholly. If this is not the case (ex. you can perform on the contract via the internet or without being hampered by the new regulations), then there is no force majeure to speak of and you would not be excused. Coronavirus, in short, is not a get-out-of-jail-free card to do work that you can (and should) do.

7. What if my goods are in transit through Metro Manila i.e Business in Bulacan and Customer in Cavite?

The movement of cargoes within Luzon shall be unhampered. This should then include cargo in transit through Metro Manila.

8. Do I still need to continue paying mandatory SSS contributions during this period?

If the self-employed member realizes no income in any given month, he shall not be required to pay contributions for that month. He may, however, continue paying contributions under the same rules and regulations

applicable to a separate employee member. (Section 11-A, RA 11199)

9. Do we still pay rent during the community quarantine?

Lessors of (1) business establishments in malls; and (2) businesses offering leisure and entertainment (such as, night clubs, bars, taverns, cocktail lounges, discotheques, beer parlors and pubs,theatre halls, gambling facilities) shall waive corresponding rental fees and charges of these establishments during the one-month period of General Community Quarantine. If your business falls under these categories then your lessor should waive rental fees and charges. (DTI Memorandum Circular 20-04)

E. FAQs for Government Offices and Services

1. What Government Offices will be open in the coming days and what services will they provide?

| OFFICE | OPERATING SCHEDULE | SERVICES PROVIDED | SOURCE |

|---|---|---|---|

| LEGISLATIVE BRANCH | |||

| Philippine Senate | March 16, 8am to 3pm | Senate is in recess | Senior Senate Staff member |

| House of Representatives | Work suspended until 12 April | Skeletal force in key departments only | Link |

| JUDICIARY | |||

| Supreme Court of the Philippines | March 16 (Flexible Work Arrangement) | Skeletal force, but “normal operation” is expected | Link |

| ALL Courts | All courts nationwide shall drastically reduce operations starting 16 March 2020 to 15 April 2020 Operations of night courts are completely suspended. | *SEE BELOW TABLE FOR FULL DETAILS | Supreme Court Administrative CIrcular No. 31-2020 dated 16 March 2020 |

| EXECUTIVE BRANCH | |||

| Securities and Exchange Commission | March 16 | No changes announced, so far | Link |

| Philippine Competition Commission | March 16 (skeletal workforce) | Expect limited services | Link |

| Philippine Ports Authority Head Office | March 16 (skeletal workforce) | No changes | PPA HRMD |

| Insurance Commission | Work suspended until 12 April 2020 | Receiving only | Link |

| Land Registration Authority | Skeletal workforce beginning March 16 | Only electronic transactions will be available; no public services except on exceptional circumstances | |

| Department of Foreign Affairs | Skeletal workforce from March 16 to April 14 | DFA branches will operate on shortened schedules; applicants with no urgent need for consular services (including passport applications) are advised to defer their visits | Link |

| Intellectual Property Office | Work is suspended from March 16 to April 14, but a skeletal workforce shall be maintained | Court hearings are suspended; no receiving of documents – deadlines (including payments) falling due from 16 March 2020 to 14 April 2020 may be filed on 15 April 2020; no manual filing of applications but online filing may be made. | Link |

| Department of Labor and Employment (Central/Regional/Field Offices and Bureaus) & DOLE Attached Agencies: Philippine Overseas Welfare Administration, Overseas Workers Welfare Administration, Professional Regulation Commission | Starting March 16, work schedule for all will be from Monday to Thursday, 7AM to 7PM | Skeletal Workforce | DOLE Administrative Order No. 99, Series of 2020; |

| National Labor Relations Commission | Work Suspended from March 15 to April 12 | 1. SEnA Unit, Complaint Unit and Labor Arbiter’s offices shall be CLOSED; 2. Cashier and Docket unit – Skeletal Work Force 3. Docket shall only receive appeals and pleadings; 4. All mandatory conciliation and mediation are considered TERMINATED and parties are mandated to FILE POSITION PAPERS one (1) month from the date of their scheduled conference; 5. All other hearings, including SEnA conferences ,are reset one (1) month from date of scheduled hearing. | NLRC COVID-19 Advisory No. 2. |

| Bureau of Customs | Compressed workweek schedule for employees, either Monday to Thursday or Tuesday to Friday 7AM to 6PM | Compressed schedules will not apply to offices rendering 24/7 services, e.g. airport, port operations, intelligence and enforcement operations | |

| Philippine Ports Authority | Skeletal workforce starting March 16 | Port management offices in Manila will remain in full commercial operations | |

| National Privacy Commission | Cancellation until further notice of ALL settings for discovery conferences, summary hearings, mediation proceedings before the Complaints and Investigation Division and Legal Division | Link | |

| Home Development Mutual Fund (Pag-IBIG) | NCR branches will be open from 9AM to 3PM on Mondays, Tuesdays, Thursdays and Fridays only | Wednesdays and weekends will be for regular disinfection of offices. Temperature screening will be conducted prior to entry. Public is encouraged to avail of services thru online channels – Virtual Pag-IBIG via www.pagibigfundservic es.com/virtualpagibig Hotline 8-Pag-IBIG (8-7244244) Email via contactus@pagibigfun d.gov.ph Chat via www.pagibigfund.gov. ph/chat | |

| Government Service Insurance System | GSIS Head Office to remain closed until March 17, skeletal workforce and WFH arrangements | Options, without having to go to a GSIS branch: 1. 905 GWAPS machines installed nationwide. Through GWAPS, members can also check their membership records and their loan balances 2. Access membership records via the Internet through the eGSISMO (Electronic GSIS Members Online). 3. For inquiries about the latest GSIS programs, members and pensioners may visit the GSIS website (gsis.gov.ph) and GSIS Facebook account. 4. Members and pensioners based in Metro Manila may also call the GSIS Hotline at (02) 8847-47-47; 1800-88474747 (for Globe and TM subscribers – free with minimum ₱8 load); or 1800-10-8474747 (for Smart, TNT and Sun subscribers – ₱8 per call) | |

| National Bureau of Investigation | Clearance processing is suspended until 13 April, 2020. | Link | |

*ALL Courts: Services Provided:

- Skeleton staff will be on stand-by.

- NO WORK in all courts, court offices, divisions, sections and units, including in SC during this period. Work that can be performed in the residence shall proceed.

- All hearings nationwide are suspended, except on urgent matters, such as those in relation to bail, habeas corpus, promulgations of judgments of acquittals, reliefs for those who may be arrested and detained, and other related actions that may be filed in relation to measures to address the declared national health emergency.

- The filing of petitions and appeals, complaints, motions, pleadings and other court submissions that fall due during the period from 15 March 2020 until 15 April 2020 is EXTENDED for THIRTY (30) calendar days counted from 16 April 2020. Those who prefer to file may do so by facsimile or through electronic means, if available.

- All court actions which are NOT considered urgent are likewise SUSPENDED and shall be rescheduled. For court actions with prescribed periods, these periods shall likewise be EXTENDED for 30 calendar days from 16 April 2020.

- All official meetings including BAC meetings, RTDs, FGDs, seminars, trainings, conventions, and functions shall be deferred, except those called or authorized by the Chief Justice or by the Judiciary Task Force on Coronavirus.

2. Will BIR adjust its deadlines?

2.a. Income Tax

On 19 March 2020, the BIR issued Revenue Memorandum Circular (“RMC”) No. 28-2020, which extends the deadline for the filing of the Annual Income Tax Return (“AITR”) to 15 May 2020, without the imposition of penalties. RMC 28-2020, in effect amends RMC No. 25-2020, issued on 18 March 2020 with respect to the AITR filing deadline. (Revenue Memorandum Circular No. 28-2020 dated 18 March 2020)

Despite the amendment, RMC No. 25-2020 still applies with respect to the following:

- Online payment option via GCash, PayMaya, Unionbank, DBP and Landbank.

- Taxpayers are allowed to submit attachments to their AITRs, as well as to amend their AITRs without imposition of penalties for deficiency taxes, until 15 June 2020. (Revenue Memorandum Circular No. 25-2020 dated 16 March 2020)

The 15 June 2020 deadline falls fifteen (15) days prior to the deadline imposed by the Securities and Exchange Commission for the filing of Annual Reports and Audited Financial Statements for the period ended 31 December 2019.

2.b. VAT, Percentage Tax, Withholding Tax and DST

Pursuant to RMC No. 29-2020, issued on 19 March, thus amending RMC No. 26-2020, issued on 17 March 2020, the following are the new due dates for the filing of various taxes:

| BIR Forms / Returns | NEW Due Date |

|---|---|

| ● Filing and payment of 2550M – Monthly VAT for non-eFPS filers ● eFiling / Filing and ePay / Remittance of 1600WP – Monthly Remittance of Percentage Tax on Winnings and Prizes Withheld by Race Track Operators | 20 April 2020 |

| ● eFiling / Filing and ePayment / Payment of 2550Q – Quarterly VAT Declaration (Cumulative for 3 months) for eFPS and non-eFPS | 27 April 2020 |

| ● eFiling / Filing and ePayment / Payment of 1702Q – Quarterly Income Tax Returns for Corporation, Partnerships and Other Non-Individual Taxpayers | 30 April 2020 |

| ● eFiling / Filing and ePayment / Payment of 2000 (DST) & 2000-OT (One Time Transaction) | 05 May 2020 |

| ● eFiling / Filing and ePayment / Payment of 1600 with Monthly Alphalist of Payees and 1606 ● eFiling / Filing and ePayment / Payment of 1600 and 1601C – Withholding Tax Remittance Return for National Government Agencies (NGAs) ● Filing and Payment / Remittance of 1601C – non-eFPS Filers ● Filing and Payment / Remittance of 2200M Excise Tax Return for the amount of Excise taxes collected from payment to sales of metallic minerals | 11 May 2020 |

2.c. VAT Refund Application

On 18 March 2020, the BIR likewise issued RMC No. 27-2020, extending the deadline for the filing of applications for VAT refund and 90 day processing period. Hence the filing of VAT refund application covering the quarter ending 31 March 2018 can still be accepted until 30 April 2020.

(Revenue Memorandum Circular No. 25-2020 dated 16 March 2020)

3. How will the filing of AITR be done?

To limit taxpayers’ exposure to persons who may be carriers or infected with the virus, taxpayers who are not mandated to use the electronic filing facilities of the BIR [e.g. Electronic Filing Payment System (EFPS), eBIRForm Facility] are encouraged to use them nonetheless.

The filing of tax returns manually can still be done by those who are not mandated to file and pay electronically, if the AITR to be filed has tax due and payable. If there is no tax to be paid, the same are expected to be filed through eBIRForm facilities.

(Revenue Memorandum Circular No. 25-2020 dated 16 March 2020)

4. What are the mandatory disclosure requirements for companies?

Publicly listed companies are mandated to disclose pursuant to Section 17 of the Securities Regulation Code (using PSE EDGE not later than 12 noon of 16 March 2020), the following: risks and impact of Coronavirus on their business operation and all measures to mitigate the risks that it will undertake or has undertaken.

http://www.sec.gov.ph/wp-content/uploads/2020/03/2020Notice_FilingOfCurrentReportSec17SRC.pdf

5. Government extensions

| DETAILS OF BENEFITS | SOURCE | |

|---|---|---|

| Quezon City LGU | Extension of deadline to pay business, real property and transfer taxes from March 31 to April 30; even with the extension, discount to early taxpayers remain in effect. | Link |

| Securities and Exchange Commission | The Commission grants the following affected companies an extension of time without penalty,within which to submit the Annual Reports and/or AFS for the period ended 31 December 2019: (i) For companies doing domestic operations only: an extension of time until 30 June 2020: and (ii) For companies with domestic and foreign operations: an extension of time until 30 June 2020 or 60 days from that date of lifting of travel restrictions/ban by the concerned government authorities, whichever comes later. | SEC Memorandum Circular No. 5, Series of 2020 |

| National Privacy Commission | Validity of registration of Personal Information Controllers and Personal Information Processors is extended until 31 August 2020 to make way for a new automated system to be launched in July. Applications for renewal of registration using new system will begin on 01 July 2020 | Link |

| Bangko Sentral ng Pilipinas | The regulatory relief measures available to supervised institutions that extend loans and credits to affected customers include: (i) exclusion from the past due loan ratio of loans to affected borrowers for a period of one (1) year, and (ii) staggered booking of provision for probable losses over an period of five (5) years, subject to prior approval of the BSP | Link |

| Insurance Commission | Submission of regular reportorial requirements falling within the Community Quarantine Period shall be extended for a period of 30 days from due date. All documentary requirements which are not considered as regular reports shall be submitted on due date originally indicated, unless the Insurance Commissioner grants an extension for such submission upon a written request. | Link |

| National Bureau of Investigation | Temporary suspension of all clearance processing operations nationwide, from 12;00 AM of 18 March 2020 until 12:00 AM of 13 April 2020. Operations to resume on 13 April 2020, unless earlier lifted, | Link |

| National Labor Relations Commission | All mandatory conciliation and mediation are considered TERMINATED and parties are mandated to FILE POSITION PAPERS one (1) month from the date of their scheduled conference; All other hearings, including SEnA conferences ,are reset one (1) month from date of scheduled hearing. | NLRC COVID-19 Advisory No. 2 |

| All Courts | The filing of petitions and appeals, complaints, motions, pleadings and other court submissions that fall due during the period from 15 March 2020 until 15 April 2020 is EXTENDED for THIRTY (30) calendar days counted from 16 April 2020. Those who prefer to file may do so by facsimile or through electronic means, if available.All court actions which are NOT considered urgent are likewise SUSPENDED and shall be rescheduled. For court actions with prescribed periods, these periods shall likewise be EXTENDED for 30 calendar days from 16 April 2020. |

6. Are the payments of utilities (water, electricity, etc) and bank amortizations suspended during this period?

| COMPANY | DETAILS OF BENEFITS | SOURCE | |

|---|---|---|---|

| Telecommunications/ICT | |||

| PLDT Home, PLDT Enterprise, and Smart & Sun Postpaid. | Extension of bill payment period for 30 days PLDT Fibr subscribers will be provided a speed boost – minimum speed of 25Mbps until April 30, applicable to residents of Metro Manila and parts of Greater Manila – Bulacan, Cavite, Laguna and Rizal | ||

| Globe Telecommunications | Extension of bill payment period for another 30 days | ||

| Cignal | Postpaid subscribers will be given a 30-day payment extension from due date. | ||

| SkyCable and internet service | Extension of bill payment period for another 30 days. Access your account information and ways to pay bills worry-free at home via MySKY.com.ph or by downloading the MySKY app. | ||

| Converge | Disconnection of delinquent accounts due to nonpayment will be suspended while quarantine is in place | ||

| Utilities | |||

| MERALCO | Extension of bill payment period for another 30 days for bills due from March 1 to April 14, 2020. Maintenance activities have also been postponed to ensure continuous service. | ||

| Maynilad | Disconnection of overdue accounts suspended until April 14. For payments, clients are encouraged to pay thru online banking or mobile fund transfer like PayMaya | ||

| Primewater | For all water bills due from March 17 to 31, payment extension of 30-days from due date | ||

| Manila Water | 30-day extension from due date for clients to pay the water bill. Payment through online channels are encouraged, such as GCash or PayMaya. | ||

| Banks, Insurance and Financial Institutions | |||

| RCBC Bankard | Auto, home, personal and salary clients in good standing with due dates from March 15 to April 15 can delay payments by 30 days. Cardholders in good standing and with due dates from March 16 to April 15 can skip their due dates and make a payment 30 days after. | Link | |

| EastWest Bank | Payment due dates for auto, personal, mortgage, and EEL loans, and credit cards shall be extended by 30 days for eligible customers. An email or sms advice will be sent to customers who will qualify under this payment extension program. | ||

| Home Credit | Offers payment extensions and fee waivers for those affected. Call 02-7753-5712 or [email protected] the subject COVID HELP and fill in survey form | ||

| PRULife UK | Effective immediately, a longer grace period from the standard 31 days to 60 days applies for all premium payments with due dates from March 16 until April 30. All payments within the extended grace period will be accepted with no interest charges | ||

| SunLife | Grace period for premium payments is extended to 91 days. This extension is applicable for policies or pre-need plans with due dates falling between Feb. 15 to May 31, 2020. Soft copies of requirements related to any insurance claims will be accepted until further notice. | ||

| FWD Insurance | Additional coverage to FWD customers, with eligible and active plans at no cost, COVID-19 benefit of P100,000 upon diagnosis; funeral benefit of P50,000Payment grace period extended up to 90 days and claims paid within 48 hours | ||

| CardMRI | Moratorium of payments from March 17 to April 12, 2020 | ||

| St. Peter Life Plan | 30-day period moratorium on all Life Plan payments during the Enhanced Community Quarantine period. | ||

| Philamlife | Additional 30 days grace period for a total of 60 DAYS for policies with due dates from March 1 to May 31, 2020 | ||

| BDO Unibank | 60-day payment extension for qualified credit card, auto loan, home loan, personal loan and SME loan with due dates of up to April 15. | Link | |

| BPI | 30-day grace period will be given to qualified customers for credit card and other types of loans “to help ease the burden during these trying times”. Terms and conditions of the program will be emailed to eligible clients. | BPI | |

| Security Bank | Payments for credit card, home, personal, auto, business mortgage or business express loans are extended by 30 days for qualified customers.Eligible customers are those with current payment status and with a payment due date of March 16 to April 14.For credit cards, waivers of finance charges are on a case-by-case basis. Late payment fees will be waived. | Link | |

| Union Bank | Qualified customers will be given a 30-day payment extension from the original due date with no late feesFees for Instapay transactions are also waived until April 14 | Link | |

| Metrobank Card | “Qualified” home loan, car loan and credit card holders will get a 30-day grace period and will be notified by email. | Link | |

| Robinsons Bank | Customers of “good standing” get a grace period for credit card, home loan, auto loan and motorcycle loan payments due from March 16 to April 15 | Link | |

| CIMB | Due date for personal loan repayment set on April 1 is moved to May 1 with no additional or late fees | Link | |

| PSBANK | Qualified auto, home and personal loan clients get a 30-day grace period on payments | Link | |

| Others | |||

| K Servico Trade, Inc. | 1 month payment holiday of monthly installment without penalty charges. | ||

| Ayala Corp. | Rent-free period for malls that are not allowed to operate during the community quarantine from March 16 to April 14 | Link | |

| Robinsons Land Corp. | Waiver of rental charges for all non-operational tenants of its various malls during the period during which the mall is closed because of the Luzon-wide community quarantine | Link | |

| SM Supermalls | Waiver of rental payments of all of tenants nationwide from March 16 to April 14 | Link | |

F. FAQs on Privacy in Reporting of Personal Data for Contact Tracing Purposes

1. What type of information can be collected for contact tracing purposes?

Only pertinent information necessary in facilitating contact tracing should be collected, such as but not limited to: travel history, and frequented locations. Likewise, the only information required to enable contact tracing shall be disclosed to the public.

Note, also that the Data Privacy Act should not prevent the government, especially public health entities from processing personal and sensitive personal information when necessary to fulfill their mandate during a public health emergency.

(source: Statement by Privacy Commissioner Raymund Enriquez Liboro on the Declaration of Public Health Emergency in Relation to Coronavirus at https://www.privacy.gov.ph/2020/03/statement-by-privacy-commissioner-raymund-enriquez-liboro-on-the-declaration-of-public-health-emergency-in-relation-to-covid-19/)

2. What considerations should be applied in disclosing personal information of PUIs and PUMs?

In line with global best practices, a balance needs to be weighed between (1) potential harm or distress to the patient arising from the disclosure and (2) potential damage to trust in doctors and the health institution vis-a-vis (1) potential harm to the public, if the information is not disclosed, and (2) potential benefits to individuals and society arising from the release of information.

(source: Statement by Privacy Commissioner Raymund Enriquez Liboro on the Declaration of Public Health Emergency in Relation to Coronavirus at https://www.privacy.gov.ph/2020/03/statement-by-privacy-commissioner-raymund-enriquez-liboro-on-the-declaration-of-public-health-emergency-in-relation-to-covid-19/)

3. Is there basis for the collection of the name and travel history of PUIs and PUMs, even without their consent?

Personal data, such as the name, travel history and frequented locations of a data subject (i.e., a PUI or a PUM), can be processed, even without his consent, in accordance with Section 12(e) of the Data Privacy Act (“DPA”), considering that such information can be deemed necessary to respond to national emergency and to comply with requirements of public order and safety.

Section 6 of Republic Act No. 11332 (Mandatory Reporting of Notifiable Diseases and Health Events of Public Health Concern Act or RA No. 11332) also requires the implementation of verification and contact tracing, and other activities which control further spread or prevent re-occurrence of outbreaks, epidemics and the like. Data collection, analysis and sharing of information from official disease surveillance systems by authorized DOH personnel and local counterparts are also exempt from the Data Privacy Act as regards access to data.

4. Is there basis for the collection of the medical history of PUIs, even without my consent?

The medical history of a PUI and a PUM, which are considered as Sensitive Personal Information under Section 3(l) the DPA, can be processed under Section13(e) of the DPA, considering that the processing is necessary to respond to a national emergency and comply with requirements of public safety.

5. Who can process personal data for contact tracing purposes?

All public and private physicians, allied medical personnel, professional societies, hospitals, clinics, health facilities, laboratories, institutions, workplaces, schools, prisons, ports, airports, establishments, communities, other government agencies, and NGOs can process personal data of PUIs and PUMs for contact tracing purposes, pursuant to their duty to report the same under Section 6(c) of RA No. 11332.

6. What should an employer do in case government officials request for the identity and other personal information of employees who are PUIs?

- Seek for a formal document-request listing the personal data being requested indicating the reasons for the request and signed by the Head of Agency asking for the information;

- Information to be provided should be limited to the minimum extent necessary aligned with the purpose of the request;

- Indicate in the letter-response the employer’s expectation that the information will be used only for the purpose for which it was requested

7. What are prohibited acts of PUIs/PUMs in relation to the reporting of information for contact tracing purposes?

Section 9 of RA No. 11332 prohibits the tampering of records or intentionally providing misinformation; as well as the non-cooperation of the person or entities identified as having the notifiable disease, or affected by the health event of public concern.

Any person or entity that misinforms or refuses to cooperate with reportorial requirements shall be penalized with a fine ranging from Php20,000 to Php50,000 and/or imprisonment ranging from one (1) to six (6) months, at the discretion of the proper court.

G. Coronavirus Government Directory

| Area of Concern | Contact Information | Contact Information |

|---|---|---|

| Coronavirus NATIONAL EMERGENCY HOTLINE | ||

| Individuals who are experiencing symptoms consistent with Covid-19 are encouraged to contact the hotline and seek further instructions | (02) 894-COVID (02) 89426843 | 1555 (for PLDT, SMART, SUN, TNT Subscribers) |

| DEPARTMENT OF TRANSPORTATION | ||

| Road Sector | (02) 7980-2387 | (0917) 876-8535 |

| (02) 7980-2390 | (0917) 876-8523 | |

| Aviation Sector | (02) 7980-2391 | (0917) 876-8573 |

| (02) 7980-2392 | (0917) 802-2224 | |

| Maritime Sector | (02) 7980-2394 | (0917) 876-8594 |

| BUREAU OF CUSTOMS | ||

| BOC Assistance Desk (in relation to Covid-19 outbreak, importation of commercial/donated emergency supplies and/or relief goods) | (0967) 225-6871 (0917) 832-2954 | |

| DEPARTMENT OF LABOR AND EMPLOYMENT | ||

| 24/7 Call Center on questions relating to local and overseas employment, right and benefits, conditions of work, wages, | 1349 | |

| labor relations, issues and related concerns on pre and post-employment of Filipino workers | ||

| DEPARTMENT OF TRADE AND INDUSTRY | ||

| DTI-related concerns | Hotline 1-384 | Website: www.dti.gov.ph |

| Facebook: @DTI.Philippines | Twitter: @DTIPhilippines | Email: [email protected] |

| DEPARTMENT OF FOREIGN AFFAIRS | ||

| Passport Appointment Concerns 8-234-3488 Passport, Authentication, & Other Consular Inquiries 8-651-9400 | DFA Home Office (02) 8 834-3000 (02) 8 834-4000 | https://consular.dfa.gov.p h/ |

| DEPARTMENT OF ENERGY (BAYANIHAN: ENERGY SERVICES 24/7 HOTLINES) | ||

| Energy consumer-related concerns during the Enhanced Community Quarantine period (15 March to 14 April 2020) | (02) 8285-6349 +63927-981-7825 +63945-208-5290 | Email: [email protected] [email protected] |

H. Annex: Table of LGU Regulations

Sources can be found here.

I. Coronavirus FAQ Contributors

Instigated and coordinated by Rocky Chan. Thank you to the following contributors:

- Cristina Montes

- Eirene Aguila

- Jan Aliling

- Karen Jill Espineli

- Kenneth Sy

- Kim Baltao-Chandra

- Lorybeth Baldrias-Serrano

- Mark Gorriceta

- Michelle Estor

- Monica Jimenez-Bigbig

- Nad Bronce

- Ninez Maningat

- Oliver Faustino

- PM Dizon

- Rocky Chan

- Rosa Alia Mendoza-Martelino

Independent

Independent